Most beginner traders believe that the process of analyzing prices is exclusively based on the chart. However, it is not entirely correct, considering that the chart represents only the past. The most we can extract from it are liquidity zones, volatility, and build assumptions based on history. How can we know the future? This is where an instrument called “Order Books” comes in. Order Books represent the future, a combination of placed orders for buying or selling. In simple terms, we can see where large blocks of whales (big players) are standing.

Price is likely to bounce off them or at least it will be difficult to pass these marks. Proper order book analytics will help you understand how capital moves in the market and how large capital operates. This is vital because they lead the market, drawing charts for hamsters. TradeFuck is an online Order Book analytics service that parses Order Books from various exchanges, such as Bitfinex, Bitstamp, Binance, HitBTC, Bitmex, Kraken, Bittrex.

Builder mode

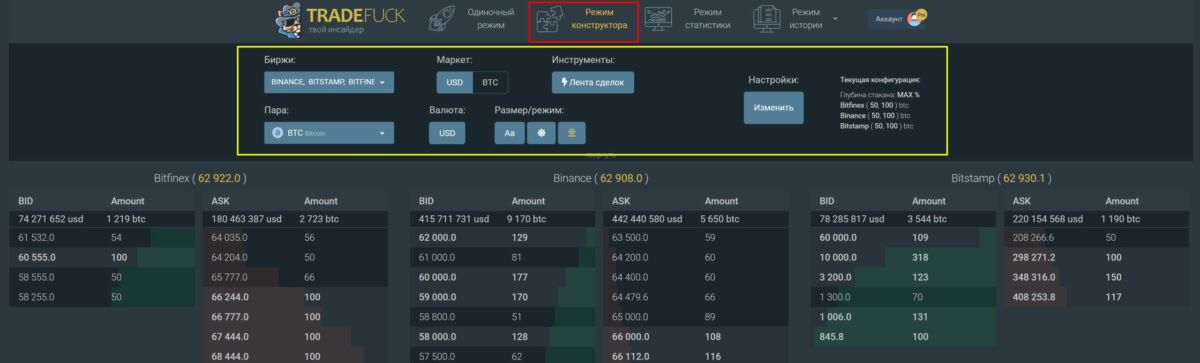

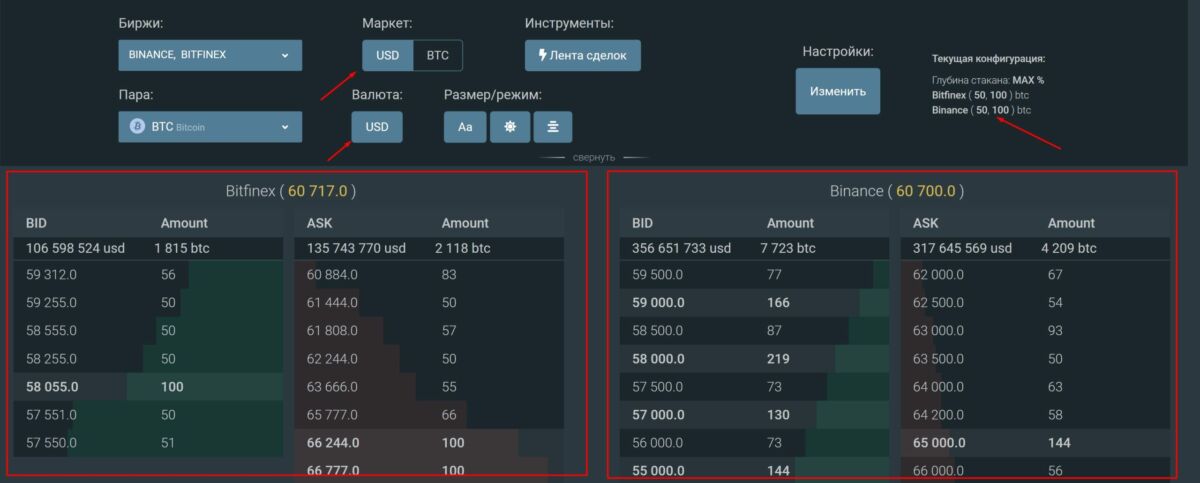

Main mode on which we will learn to work. Let’s take a look at the settings panel (highlighted in yellow on the screen).

The “Exchanges” tab – I recommend checking out Bitfinex and Binance. If you don’t know, there are whales on the Bitfinex exchange.

The “Pair” tab – pick the coin you’re interested in.

The “Layout” tab – displays order prices in USD or BTC in a stack.

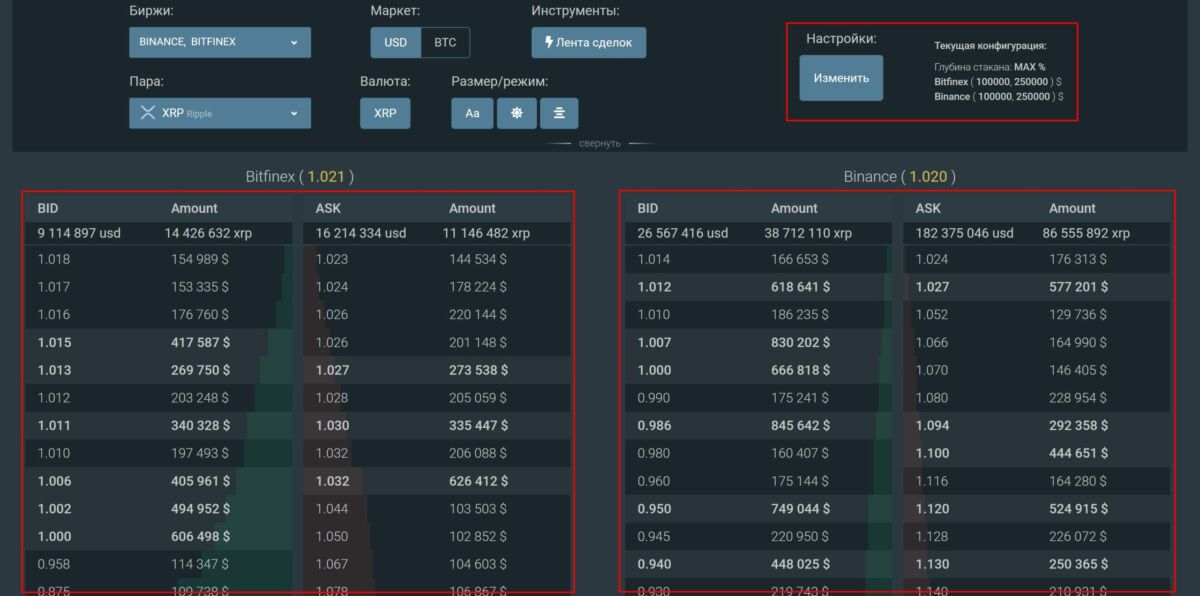

The “Currency” tab – if USD mode is selected, the amount of coins in orders will be displayed in dollars. Useful for cheap coins.

The “Tools” tab – a transaction feed, we’ll talk about it in detail below.

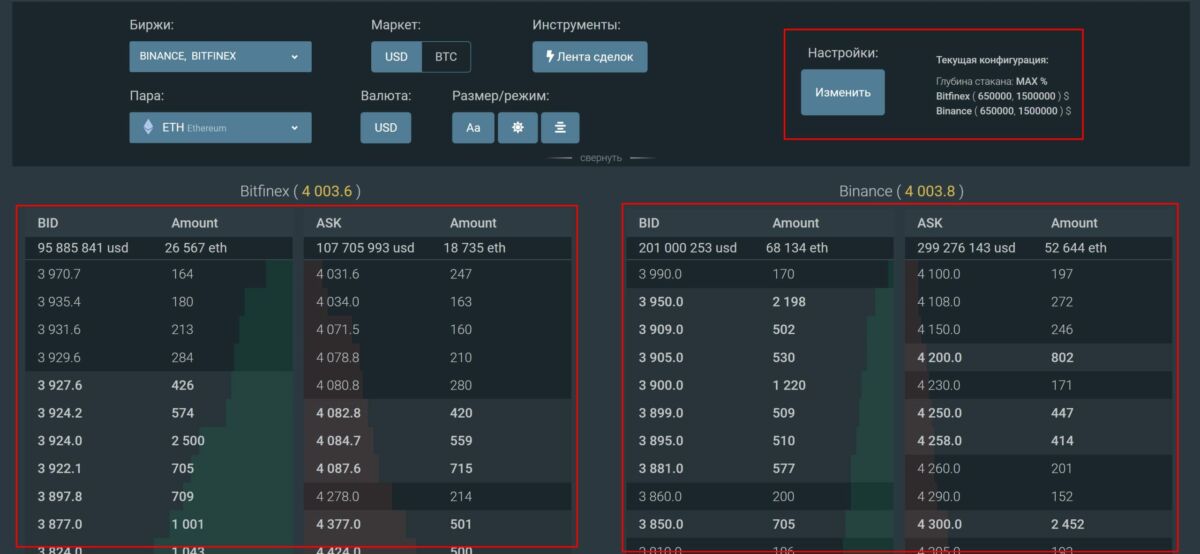

The “Settings” tab – the main tab where we’ll set filters. For each coin, they will be different, depending on its market cap and price. I’ll give you settings for 3 coins BTC, ETH, XRP.

Mode Constructor

The main mode on which we will learn how to work.

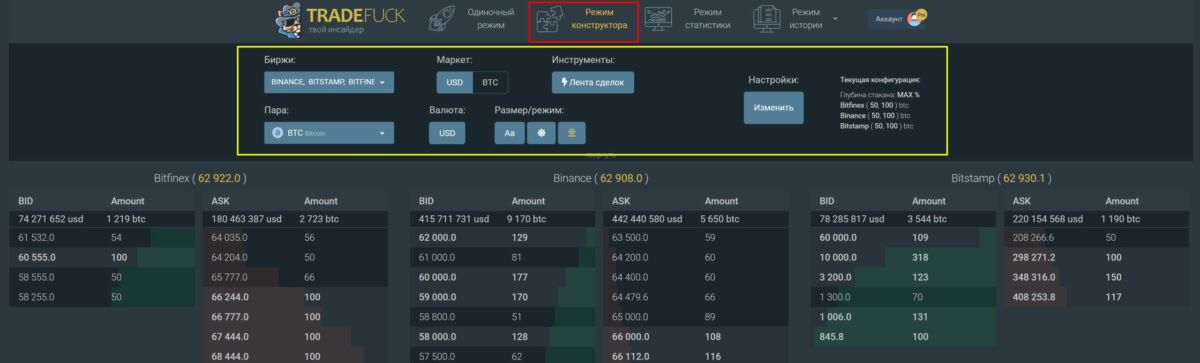

Let’s look at the settings panel (indicated in yellow in the screenshot).

“Exchanges” tab – I recommend keeping an eye on Bitfinex and Binance. If you don’t know, whales sit on the Bitfinex exchange.

“Pair” tab – choose the coin we are interested in.

“Layout” tab – displays orders in USD or BTC in the order book.

“Currency” tab – if the USD mode is selected, the number of coins in the orders will be displayed in dollars. Useful for cheap coins.

“Tools” tab – trading history, we will talk about it in more detail below.

“Settings” tab – the main tab where we will set filters. For each coin, they will be different, depending on its market capitalization and price. I will give you settings for 3 coins: BTC, ETH, XRP.

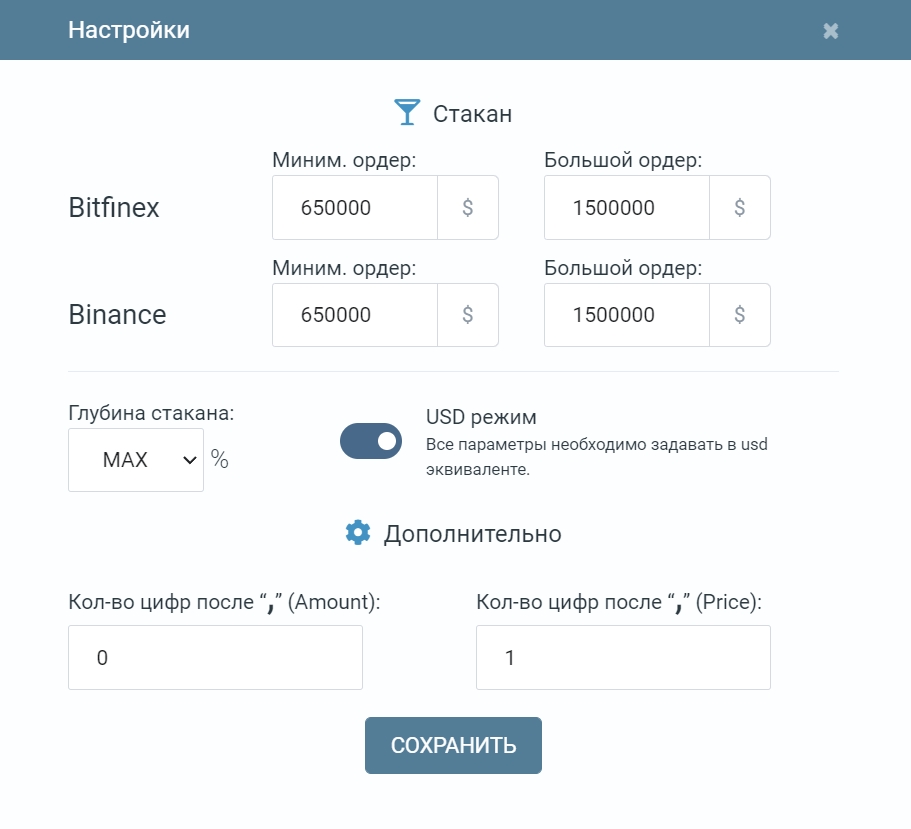

Setting up filters for glasses

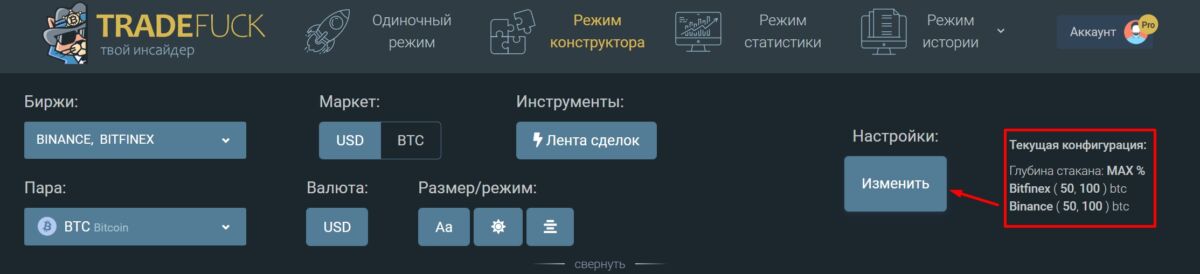

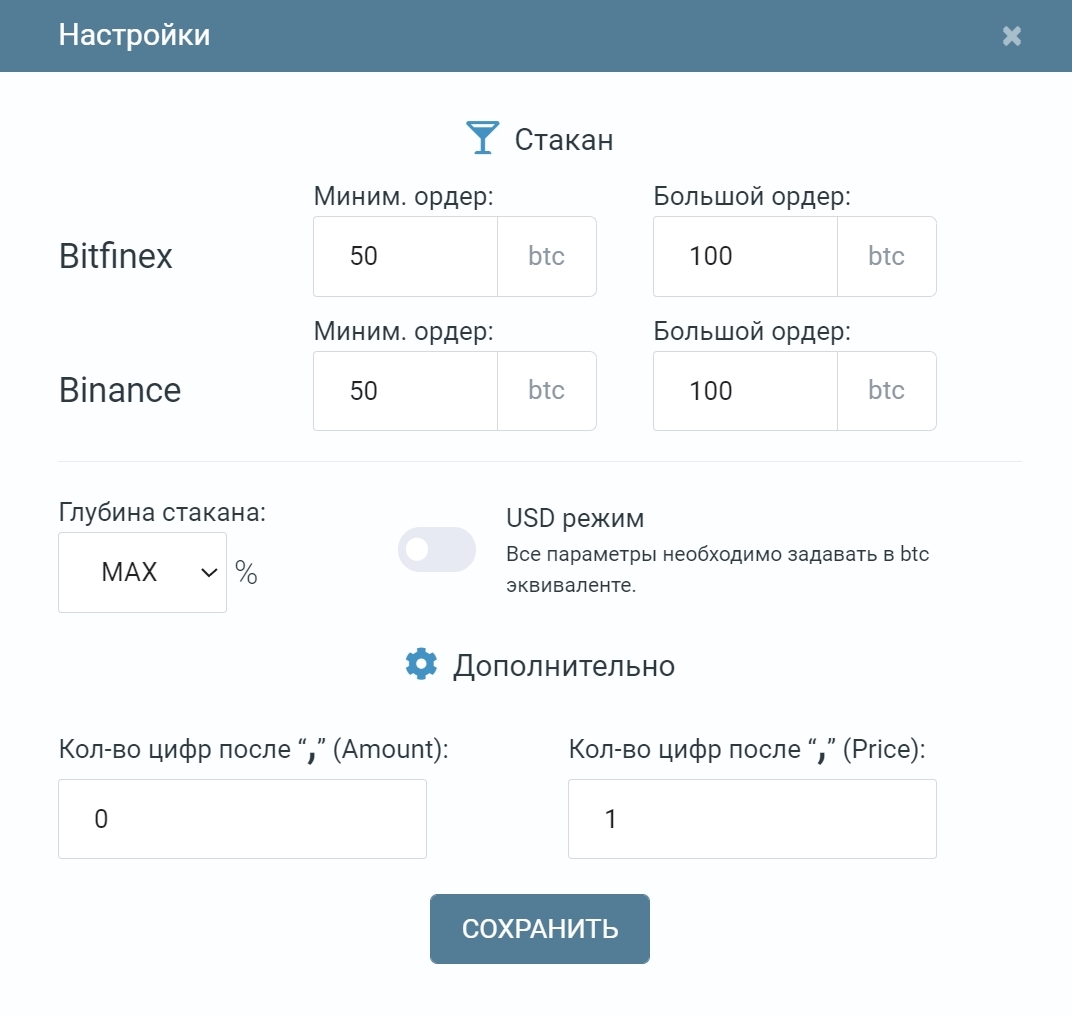

We do everything as shown in the screenshots below. To open additional settings for the glass, click the button “Settings – Change“.

BTC

Minimum order – 50 BTC. Maximum – 100 BTC.

Depth of the book – MAX. The rest is set to default (as in the screenshot). This way, we can see at what price a large capital is placed – starting from $6,000,000 (at the current rate of $60,000 per Bitcoin).

If you are reading this article when Bitcoin is already worth $1,000,000, then you need to set the filter not in BTC, but in USD. Look for minimum orders of 2-3 million and larger ones starting from 6 million.

Leave a Reply